|

【序言】爱股网投资文摘收录50多名国内知名价值投资博客的文章,从而为广大用户提供最新、最有价值的投资文摘。在这里你可以领略投资高手们的投资理念,关注他们的投资组合,了解他们的选股思路以及他们对个股和行业的看法。

—————————————————————————————————————————————2011-08-26 22:05:06 新浪博客 刘建位__学习巴菲特

Buffett tells us he came up with the idea of an investment while

taking a bath earlier this week, and he asked BofA CEO Brian

Moynihan yesterday if Berkshire could do the deal.

巴菲特:救援美银来自浴缸灵感

http://finance.sina.com.cn/stock/usstock/c/20110826/155810386767.shtml

2011年08月26日 15:58 新浪财经

新浪财经讯 北京时间8月26日下午消息,据外电报道,沃伦·巴菲特(Warren

Buffett)是全球第三大富豪,他似乎还喜欢在浴缸中放松时作出扭转市场的金融决定。

周四,巴菲特宣布他的公司伯克希尔哈萨韦(Berkshire Hathaway)将购买美国银行(Bank Of

America)50亿美元优先股。这一消息刺激美银股价周四早盘飙升26%,不过收盘涨幅收窄至不足10%。

有批评者怀疑巴菲特是否迫于压力救援美银。巴菲特说,不是这么回事。在与巴菲特电话联系之后,CNBC的贝基-奎克(Becky

Quick)周四表示:“他说他只是周三上午在浴缸中突发灵感,想到了这个主意。”

这笔交易被人们与先前金融危机期间巴菲特向高盛(Goldman

Sachs)投资50亿美元相提并论,不仅仅因为二者所伴随的风险,也因为当年这个“浴缸”就曾经出现过。

据《纽约时报》2008年9月24日报道,巴菲特在向高盛注资之后称:“现在经济有点像一个浴缸。前面是凉水,后面是热水。”(振玉)

高盛研报:巴菲特投资提振信心 买入美银

http://finance.sina.com.cn/stock/usstock/c/20110826/190610387492.shtml

2011年08月26日 19:06 新浪财经

新浪财经讯

8月25日巴菲特宣布向美国银行(Bank of

America,美银)投资50亿美元。高盛认为巴菲特的投资主要有助于提振市场对美银股价的信心,与银行增强资本比率的关系则不大;今后几个季度美银可

吸收400亿美元的损失,仍能满足相关的资本比率标准。高盛重申对美银的买入评级,目标股价10美元。8月25日美银收于7.65美元。

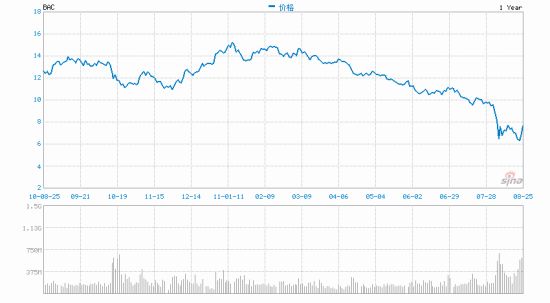

美银过去一年的股价走势

以下是高盛研报摘要:

巴菲特投资50亿美元

美国银行昨日宣布,股神巴菲特将向银行投资50亿美元的累积优先股。我们认为,巴菲特的投资意在为美银股价注入信心而非增加其资本,因为该交易

当前阶段只能提供很少的普通资本效益。虽然巴菲特此举有助于提高投资者对美银股价的信心,但贷款服务和解、回购和解、抵押诉讼风险、宏观环境不确定等多项

关键风险犹存。虽然衡量这些风险的大小比较困难,但我们认为美银今后几个季度可吸收400亿美元的损失,2012年第4季度仍具备6%的“巴塞尔协议

III”资本比率。

我们仍然认为美银将采取进一步的措施,追求非稀释形式的资本比率提高,其中包括出售非核心资产、处理部分中国建设银行(

4.56

,

-0.05

,

-1.08%

)(CCB)股票。这些措施应能继续有助于平复市场对其资本基础稳固程度的担忧。

重申买入评级,修正每股收益预期

我们重申对美银的买入评级,原因是我们认为市场对美银的不利处境反应过度。我们将美银2011、2012年的每股收益预期分别从0.25美元和1.25美元修正至0.26美元和1.20美元,以体现巴菲特50亿美元投资的效果。

估值

我们的12个月目标股价仍为10美元,对应美银2012年预期每股收益1.20美元的8.3倍。

关键风险

房地产市场、监管、进一步回购抵押贷款等风险。(云翔/编译)

Buffett Tells CNBC 'This Isn't 2008' As

Bank of America Gets $5B Loan at Just 6%

Published: Thursday, 25 Aug 2011 | 9:42 AM ET

Text Size

By: Alex Crippen

Executive Producer

http://www.cnbc.com/id/44271446

|

Getty Images

Warren Buffett

|

Warren Buffett tells CNBC's Becky Quick "this isn't 2008" and

that's why Bank of America is getting better terms for its

$5

billion loan today from Berkshire

Hathaway, compared to what

General Electric and

Goldman Sachs paid for similar

loans almost three years ago at the height of the credit crisis.

Bank

of America shares [BAC

7.531

-0.119

(-1.56%)

] jumped more than 9 percent

to close at $7.65 in trading on Thursday.

Buffett is also

stressing the investment was his idea, perhaps to downplay any

fears that Bank of America is desperate for a cash infusion.

This morning,

Bank of America announced that

Berkshire will use cash to buy 50,000 shares of preferred stock

with a liquidation value of $100,000 per share in a private

offering.

That is, in

effect, a loan to the bank, in which it will pay around $300

million in dividends each year to Berkshire. BofA

can pay back that loan at any time, but it will have to make an

additional 5 percent dividend payment to do so.

The interest rate on the loan is 6 percent, well below the 10

percent that Buffett got from GE and Goldman almost three years

ago, but not at all bad with 10-year

Treasuries just above 2.2 percent.

Goldman

paid back its $5 billion loan in April of

this year, sending Berkshire roughly $1.6 billion in dividends over

the 2-1/2 year life of the deal. That's an

annualized return on investment of 12.6 percent.

Warrants that came with that deal are out of the money, with

Goldman trading a few dollars below the $115 strike price. Current

price: [GS

108.63

-1.21

(-1.1%)

]

Buffett had said

he didn't want Goldman to buy back its preferred shares, because it

cut off the stream of $500 million a year going from Goldman to

Berkshire. He's also indicated he doesn't plan to

exercise the Goldman warrants until just before they expire in

2013.

General Electric

has said it will pay off its $3 billion loan this

October. Berkshire will pocket a total of $1.2

billion in dividends over that deal's three years for an annual

return on investment of 11.1 percent. Like

Goldman, warrants in that deal are also out of the money, with GE

trading almost seven dollars below the $22.25 strike

price. Current price: [GE

15.20

-0.25

(-1.62%)

]

In today's deal,

Berkshire gets warrants to buy up to $5 billion of BofA's common

stock, 700 million shares at an exercise price of just over $7.14 a

share. It can make those

purchases at its discretion anytime in the next 10 years.

That gives

Berkshire the potential to become BofA's largest

shareholder. State Street is currently at the

top of that

list with 460.5 million shares, about 4.5

percent of the bank's outstanding shares.

(Berkshire

sold a 5 million share stake in BofA

during 2010's fourth quarter. It had been

purchased by the

now-retired GEICO stock picker

Lou Simpson.)

As was the case

with GE and Goldman, Bank of America also gets a

strong endorsement from

Buffett. He calls the

investment a vote of confidence in both BofA and the United

States.

In the release,

Buffett says, "Bank of America is a strong, well-led company, and I

called Brian to tell him I wanted to invest in

it. I am impressed with the

profit-generating abilities of this franchise, and that they are

acting aggressively to put their challenges behind them. Bank of

America is focused on their customers and on serving them well.

That's what customers want, and that's the company's strategy."

Buffett tells us

he came up with the idea of an investment while taking a bath

earlier this week, and he asked BofA CEO Brian Moynihan yesterday

if Berkshire could do the deal.

Why

now? Buffett tells Becky that BofA's shares "have

gone down a lot" and the bank is "certain to be around" for a long

time.

He says Wells

Fargo [WFC

23.99

-0.77

(-3.11%)

], a large Berkshire holding,

and BofA have the best deposit franchises in the country, and

compares today's investment to Berkshire's past deals for GEICO and

American Express [AXP

47.44

-0.65

(-1.35%)

].

RELATED LINKS

- BofA's China

Bank Stake Faces Tough Sale

- Buffett

Invests $5B in BofA

- Berkshire

Hathaway's 15 Biggest Stock Holdings

- Warren Buffett

Gets Unwanted $5.5 Billion Check from Goldman Sachs

Current Berkshire

stock prices:

Class B:

[BRK.B

68.57

-0.42

(-0.61%)

]

Class A:

[BRK.A

102824.00

-667.00

(-0.64%)

]

For more

Buffett Watch updates follow alexcrippen on

Twitter.

Email

comments to buffettwatch@cnbc.com

General

Electric has a 49 percent stake in NBCUniversal, CNBC's parent

company.

© 2011 CNBC, Inc. All Rights

Reserved

—————————————————————————————————————————————

【备注】该文章来源于http://blog.sina.com.cn/s/blog_53c8e9ab0102dsmo.html,爱股网不对其内容负责。请各位运用独立思考的能力,去其糟粕、取其精华。 |